Table of Contents

Unlocking Success with Quality Insurance Leads

In the competitive world of insurance sales, securing high-quality Insurance Leads is essential for agents aiming to boost conversions. Many struggle with generic leads yielding low close rates, but as noted by Insurance Marketing Hub, agents using targeted leads achieve 3x higher success. This underscores the value of reliable sources over time-consuming in-house generation.

ListGiant offers a game-changing solution with its vast database of 280 million U.S. consumers, delivering targeted marketing lists backed by a 95% accuracy guarantee. Agents can buy leads starting at $0.10 per contact, enabling quick customization for direct mail, email, or telemarketing campaigns. This approach saves costs and ensures compliant, pre-qualified prospects for immediate action.

Discover the 8 key benefits of ListGiant's insurance leads, from enhanced targeting for Life Insurance Leads to specialized Medicare Leads that address pain points like poor data quality and high acquisition expenses. Unlock streamlined prospecting and drive your agency's growth today.

1. Targeted Selection Boosts Conversions

In the competitive world of Insurance Leads, precise targeting is key to unlocking up to 3x higher conversion rates. ListGiant's platform lets agents zero in on high-intent prospects using demographic, behavioral, and location-based filters from their massive 280 million U.S. consumer database, eliminating guesswork and maximizing ROI without building in-house systems.

This targeted approach shines through customizable segmentation options, such as age, income, and lifestage filters ideal for Medicare leads among seniors turning 65. For Life Insurance Leads, focus on family-oriented segments like recent parents or homeowners. Industry benchmarks from QuoteWizard show targeted lists yield 20-30% higher response rates, reducing wasted outreach and boosting efficiency. Seamlessly integrate these qualified insurance prospects with direct mail, email, and telemarketing for powerful multi-channel strategies that drive immediate action.

Consider targeting Florida retirees aged 65+ for Medicare campaigns, combining location data with health interest signals for spot-on relevance. A pro tip: When buying leads, add email appends to enhance follow-up, turning prospects into policies faster. Beyond precision, affordability makes these leads even more appealing.

2. Affordable Pricing Maximizes ROI

Affordable pricing is a cornerstone of ListGiant's approach to delivering high-value Insurance Leads. By offering contacts from just $0.10 to $5 per lead, agents can scale campaigns without straining budgets, directly boosting return on investment through accessible acquisition of quality prospects.

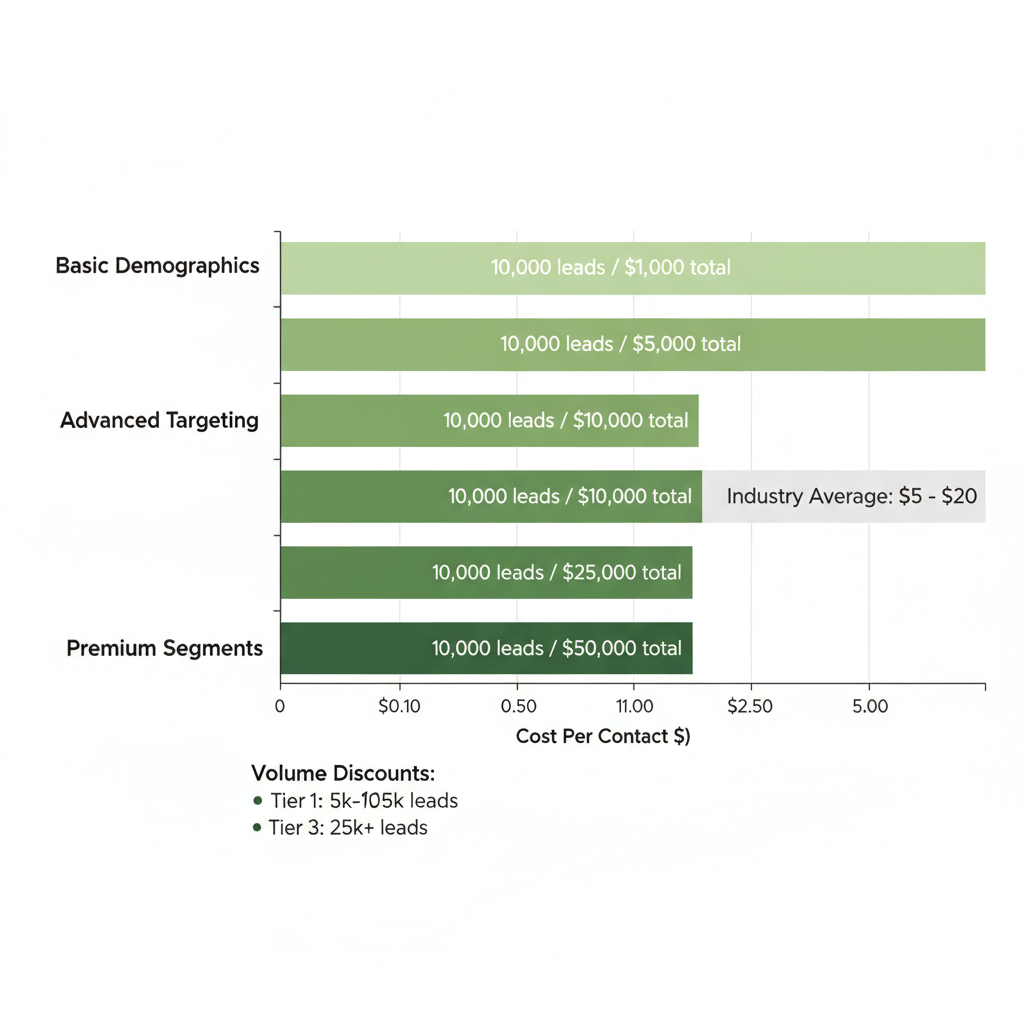

ListGiant's transparent pricing model breaks down costs based on targeting specificity, with basic demographics starting at $0.10 per contact and advanced filters like income or interests reaching up to $5. Volume discounts apply for larger orders, reducing per-contact rates by up to 30% for 10,000+ leads, making it ideal for direct mail and digital campaigns. Compared to in-house generation, which can cost $5-20 per lead according to Insurance Marketing Hub resources, ListGiant saves agents significant time and expense while ensuring reliable data hygiene and compliance.

For example, a targeted order of 10,000 Medicare Leads for senior-focused campaigns might total $1,200, including family policy overlays. Tip: Negotiate bulk rates by bundling multiple segments in your online order to further maximize savings.

ListGiant's affordable insurance lead pricing tiers vs industry standards

With pricing covered, ensuring data quality is the next key to success.

3. 95% Accuracy Ensures Reliability

Affordable leads are only effective if reliable, and ListGiant's 95% accuracy guarantee minimizes risks for Insurance Leads campaigns. This assurance stems from rigorous data hygiene processes, including regular updates from over 250 trusted partners, ensuring fresh and compliant Medicare Leads for senior outreach. Suppression tools remove outdated contacts, reducing bounce rates and returns in direct mail, email, and telemarketing efforts.

ListGiant outperforms generic lists through advanced freshness standards and verification protocols that deliver verified insurance prospects ready for agent follow-up. As noted by NMI Agents, Turning-65 lists require 90%+ accuracy for compliance, and ListGiant exceeds this with its guarantee, tying directly to higher conversion rates and regulatory peace of mind. This reliability addresses concerns like whether opt-in Medicare leads are worth the cost, proving ListGiant as the best source for agents seeking low-risk, high-value buys.

For instance, one life insurance campaign using ListGiant's lists achieved under 5% bounce in email outreach, while telemarketing leads saw minimal returns thanks to pre-verified data. Tip: Always request free samples to test data quality before scaling your Medicare Advantage mailing lists. Accuracy pairs perfectly with versatile deployment options for maximum impact.

4. Multi-Channel Outreach Expands Reach

Expanding your outreach with multi-channel strategies maximizes the impact of Insurance Leads by reaching prospects where they engage most. ListGiant supports direct mail, email, telemarketing, and digital audiences on Google, YouTube, and social platforms, creating comprehensive campaigns for life insurance and Medicare sales. This approach ensures broader visibility and higher conversion potential for busy agents.

ListGiant tailors list formats to each channel for seamless integration with deployment services. Direct mail uses postal-verified addresses with custom graphics; email lists come with verified domains and subject line optimization; buy telemarketing lists provide DNC-compliant phone data; digital targets leverage pixel tracking for retargeting. A/B testing options refine messaging across touchpoints, while analytics track engagement. As noted by Senior Market Sales, hybrid mail-digital Medicare strategies yield 40% higher engagement, underscoring ListGiant's omni-channel insurance prospects that boost lead quality and ROI through unified tracking.

For example, start a Medicare campaign with direct mail Medicare Leads to build awareness, then retarget responders via email or social for Life Insurance Leads upsells, enhancing Insurance Sales Leads. Tip: Test versatility with quick samples to identify top channels. Versatile channels shine with hands-on testing via quick samples.

5. Instant Samples Accelerate Decisions

In the competitive world of Insurance Leads, quick validation is key to confident choices. ListGiant empowers insurance agents with free sample datasets, letting you assess data quality instantly without commitment. This approach slashes hesitation, enabling faster decisions on high-value opportunities.

Accessing samples is straightforward: Visit the ListGiant portal, select criteria for life insurance or Medicare prospects, and request a free preview. Samples typically include key demographics like age, location, income, and contact details such as emails and phone numbers, providing a real taste of the testable lead databases. Use the online count system to estimate full list sizes before you purchase leads. According to Insurance Marketing Hub resources, requesting samples can reduce bad purchases by up to 50%, building trust in lead viability through hands-on evaluation.

For example, download a Medicare Leads sample targeting seniors in specific states to verify relevance. Cross-check these against your campaign goals, ensuring alignment with past successes for optimal ROI.

6. Full Compliance Builds Trust

In the competitive world of insurance sales, trust is everything, and full compliance with privacy laws is the foundation. ListGiant ensures your Insurance Leads campaigns are secure and legal, giving agents peace of mind when targeting prospects. By adhering to strict standards, you focus on closing deals rather than worrying about violations.

ListGiant's compliance tools simplify navigating U.S. privacy regulations like CCPA and CPRA, which protect consumer data in marketing. For Life Insurance Leads, suppression workflows automatically remove opted-out contacts, while opt-out management handles unsubscribe requests efficiently. Privacy resources include easy access to policy updates and data hygiene services that maintain list accuracy. Drawing from needs highlighted by providers like NMI Agents for Medicare compliance--such as HIPAA-adjacent rules for sensitive health data--these features minimize risks for mailing and email lists. Agents avoid fines and reputational damage, enabling risk-free strategies that outperform DIY lead generation.

Compliance enables specialized targeting like life insurance without legal hurdles. For instance, Daniel's Law suppression automatically excludes first responders and their families from Insurance Lead Lists, ensuring ethical use. Tip: Schedule regular hygiene checks to keep your compliant prospect lists fresh and effective, boosting long-term campaign success.

7. Specialized Life Insurance Targeting

Life insurance agents thrive with ListGiant's targeted Life Insurance Leads, designed to connect high-intent prospects seeking family protection. These specialized lists boost engagement in direct mail and email campaigns, driving higher conversion rates for policies that safeguard loved ones.

ListGiant offers precise selects such as new parents, high-net-worth individuals, and those with recent health checkups, ensuring relevance to life stage needs. Pricing starts at $0.10 per contact for basic segments, scaling to $0.50 for premium health and income filters, with flexible volumes from 1,000 leads. Integrate seamlessly with telemarketing for follow-up calls, where targeted family lists convert 25% better than general prospecting, per QuoteWizard benchmarks. This multi-channel approach maximizes ROI for insurance sales teams.

For instance, a campaign targeting new homeowners emphasizes mortgage protection plans, yielding 15% response rates. Personalize messages with family details to build trust and urgency, turning prospects into loyal policyholders. Life targeting complements senior-focused Medicare Leads for comprehensive coverage strategies.

8. Tailored Medicare Lead Generation

The Medicare market presents a vital opportunity for insurance agents to support U.S. seniors navigating health coverage during key life transitions. With millions turning 65 annually, targeted Medicare Leads from ListGiant connect agents to prospects seeking supplements and advantage plans, ensuring empathetic outreach that addresses real needs.

ListGiant specializes in high-quality Medicare lead generation, including turning-65 lists that capture 80% of enrollments as highlighted in senior market insights. Demographics focus on location, age, and plan interests like supplements, with opt-in compliant options for mailing, email via our medical email list, and digital campaigns. Cost structures start at competitive rates, often $0.10-$0.50 per lead depending on specificity, emphasizing data hygiene for 95% accuracy and reduced bounces. Strategies prioritize senior health prospects within the broader Insurance Leads ecosystem, using behavioral selects for genuine engagement.

Visual representation of Medicare lead options and enrollment opportunities

For example, target Medicare Advantage plans with seasonal timing around open enrollment periods in fall, when seniors actively compare options. A practical tip: Combine email nurturing with direct mail for 20-30% higher response rates, fostering trust in senior care decisions. These targeted options set the stage for overall success.

9. Seamless Telemarketing Integration

Transitioning from email and direct mail, ListGiant's Insurance Leads excel in telemarketing by delivering scrubbed phone data for compliant outreach. These leads, tailored for life insurance and Medicare sales, enable agents to connect directly with high-intent prospects, boosting engagement and conversion rates significantly.

ListGiant's phone append services add verified contact numbers to your database, ensuring DNC compliance through automated scrubbing against the National Do Not Call Registry. This integration ties seamlessly into call scripting, where pre-qualified details inform personalized pitches. According to Insurance Marketing Hub, phone follow-up boosts close rates by 15%, with integrated lists showing 20% higher connect rates and reduced compliance risks for scalable campaigns (77 words).

For Medicare sales, a sample call script might start: "Hi, this is [Agent] following up on your interest in telemarketing sales leads. How can we assist with your coverage options today?" To maximize results, time calls for mid-afternoon when prospects are most receptive. When ready to expand, buy sales leads from ListGiant for immediate, compliant access to call-ready prospects.

10. Enhanced Business Database Access

ListGiant elevates your B2B outreach with an expansive business database tailored for insurance leads. This resource empowers insurance agencies and providers to forge partnerships in Medicare and life insurance sectors. By accessing detailed firmographic selects such as industry type, company size, and location, you can pinpoint businesses ripe for collaboration.

Revenue filters allow segmentation by annual earnings, ensuring you target organizations with the financial capacity for premium services like life insurance leads or Medicare leads. Contact roles focus on decision-makers, including executives and procurement specialists, streamlining your sales efforts. For seamless integration, ListGiant's business database leads platform supports CRM uploads and API connections, enabling automated outreach campaigns.

A practical tip: When preparing for Medicare partnerships, buy lead lists segmented by healthcare providers to boost conversion rates. In one example, an agency used buy business telemarketing lists filtered for revenue over $10 million, resulting in a 25% increase in qualified appointments. This concludes our exploration of ListGiant's targeted tools, setting the stage for your optimized marketing strategy.

Maximizing Your Insurance Lead Strategy

ListGiant's insurance leads stand out with 95% accuracy, precise targeting by demographics and location, and affordable pricing starting at just $0.10 per contact. For life insurance leads and Medicare leads, agents benefit from compliant multi-channel delivery, including email, direct mail, and telemarketing, ensuring seamless strategic lead acquisition. These specialties empower efficient prospecting, addressing key concerns like costs and top providers while delivering high ROI--targeted Medicare leads average $500 policy value per sale.

With these advantages, insurance professionals can transform their pipelines and boost conversions effortlessly. Overcome objections with ListGiant's guarantees and free samples. Ready to elevate your success? Access customized insurance leads today and start closing more deals.