Table of Contents

Navigating Insurance Sales Leads for Agents

In today's competitive insurance landscape, Insurance Sales Leads are the lifeline for agents seeking to grow their client base efficiently. Imagine spending hours on cold calls with minimal returns--now picture connecting directly with pre-qualified prospects eager for coverage. This shift from outdated methods to data-driven strategies can transform your sales pipeline, saving time and increasing revenue.

Insurance sales leads represent qualified insurance prospects who have expressed interest in policies like life insurance leads or auto insurance leads. Providers like ListGiant offer access to a massive database of 280 million U.S. consumers, enabling precise targeting by demographics, behaviors, and needs. Their Insurance Leads ensure high accuracy with a 95% guarantee, helping agents focus on high-potential opportunities rather than sifting through noise.

Yet, challenges persist: low-quality leads can yield conversion rates as low as 1-2%, compared to 5-10% from vetted sources, as noted in industry guides on lead buying. High costs and data inaccuracies further complicate targeted lead acquisition. As one agent shared, "Switching to reliable leads doubled my closings in months."

This guide explores understanding leads, their benefits, acquisition processes, and best practices. Start by grasping fundamentals, then dive into Insurance Lead Lists for segmentation that maximizes ROI and compliance.

Key Concepts in Insurance Lead Generation

Understanding the basics of insurance sales leads is essential for agents aiming to grow their client base efficiently. These leads represent prospective policyholders who have shown interest in coverage, allowing targeted outreach that boosts conversion rates. Providers like ListGiant leverage vast databases to deliver reliable options, setting the stage for effective sales strategies.

Defining Quality Insurance Sales Leads

Quality insurance sales leads stand out through their qualification levels, source reliability, and direct relevance to specific insurance needs, such as life and auto coverage. High-quality leads are typically exclusive, meaning they are sold to only one agent, unlike shared leads that multiple agents pursue, leading to fiercer competition and lower close rates. Qualification involves verifying intent through behaviors like online quote requests or recent life events, ensuring the prospect matches the agent's target demographic.

Source reliability is paramount, drawing from trusted consumer databases that append demographics like age, income, and location for precision. ListGiant exemplifies this with its 280 million consumer database, applying rigorous hygiene processes to maintain 95% accuracy and reduce invalid contacts. For life and auto insurance needs, relevance means aligning leads with factors like family status for life policies or vehicle ownership for auto quotes, enabling agents to focus on high-potential prospects.

Using marketing list services from established vendors ensures deliverability guarantees, such as suppression of outdated records, which can yield 80% higher conversions according to industry benchmarks. Agents should evaluate vendors on database size, exclusivity options, and compliance adherence to select leads that drive real results. This approach answers key questions like how to qualify insurance sales leads by prioritizing intent signals and demographic fits.

Types of Insurance Leads: Life vs Auto

Insurance leads vary significantly by type, with life insurance leads emphasizing long-term planning tied to lifestage events and auto insurance leads focusing on immediate, transactional needs linked to vehicle and homeowner data. Life insurance leads target individuals navigating major changes, such as new parents or recent marriages, fostering relationships that build toward comprehensive policies. In contrast, auto insurance leads capitalize on timely opportunities like recent car purchases or policy lapses, often bundled with home coverage for added value.

Segmentation enhances both types, allowing agents to filter by age, location, and intent for personalized outreach. For instance, life insurance leads can be narrowed to young families in urban areas showing quote interest, while auto insurance leads might focus on drivers with clean records in suburban zones. Using targeted marketing lists, ListGiant enables such precise selects, drawing from DMV records for auto and behavioral data for life to illustrate robust possibilities.

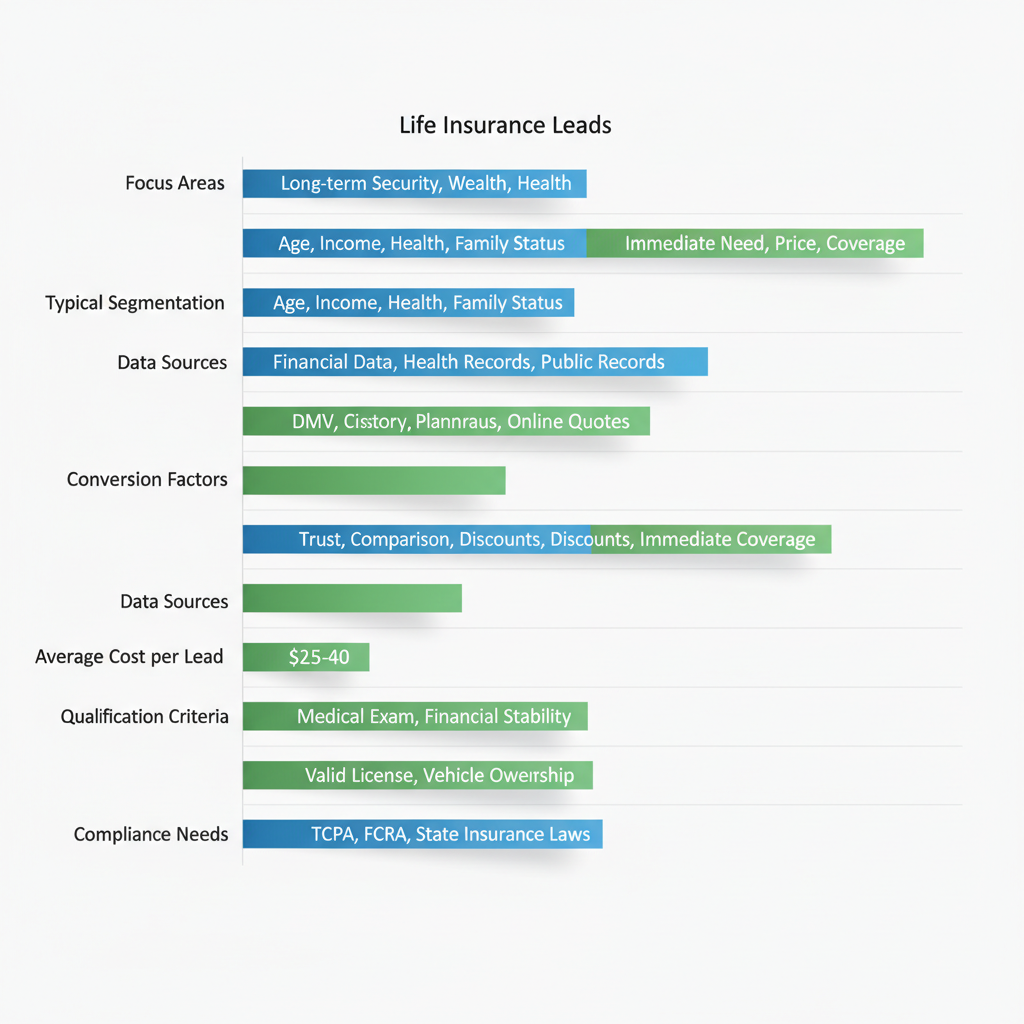

Effective segmentation benefits agencies by matching leads to clientele strengths, whether nurturing long-term life clients or closing quick auto deals. The following table compares key attributes of life and auto insurance leads to help agents evaluate suitability:

| Attribute | Life Insurance Leads | Auto Insurance Leads |

|---|---|---|

| Focus Areas | Lifestage events, health, family status | Vehicle ownership, driving history, bundling with home |

| Typical Segmentation | Age, income, location, recent life changes | Vehicle type, location, credit score |

| Data Sources | Consumer databases, behavioral signals | DMV records, property data |

| Conversion Factors | Long-term relationship building | Immediate quoting and discounts |

| Average Cost per Lead | $20-50 | $15-40 |

| Qualification Criteria | Intent signals like quote requests | Recent purchases or lapses |

| Compliance Needs | Health data privacy (HIPAA) | CCPA for personal data |

Comparison of life vs auto insurance leads attributes and costs

This comparison, backed by ListGiant's data standards and industry benchmarks, highlights how life leads suit agencies focused on advisory roles, offering higher lifetime value despite elevated costs, while auto leads provide quicker wins for volume-driven teams. By grasping these differences, agents can select segmented prospect data that aligns with their goals, paving the way to unlock greater value in subsequent strategies.

Advantages of High-Quality Insurance Leads

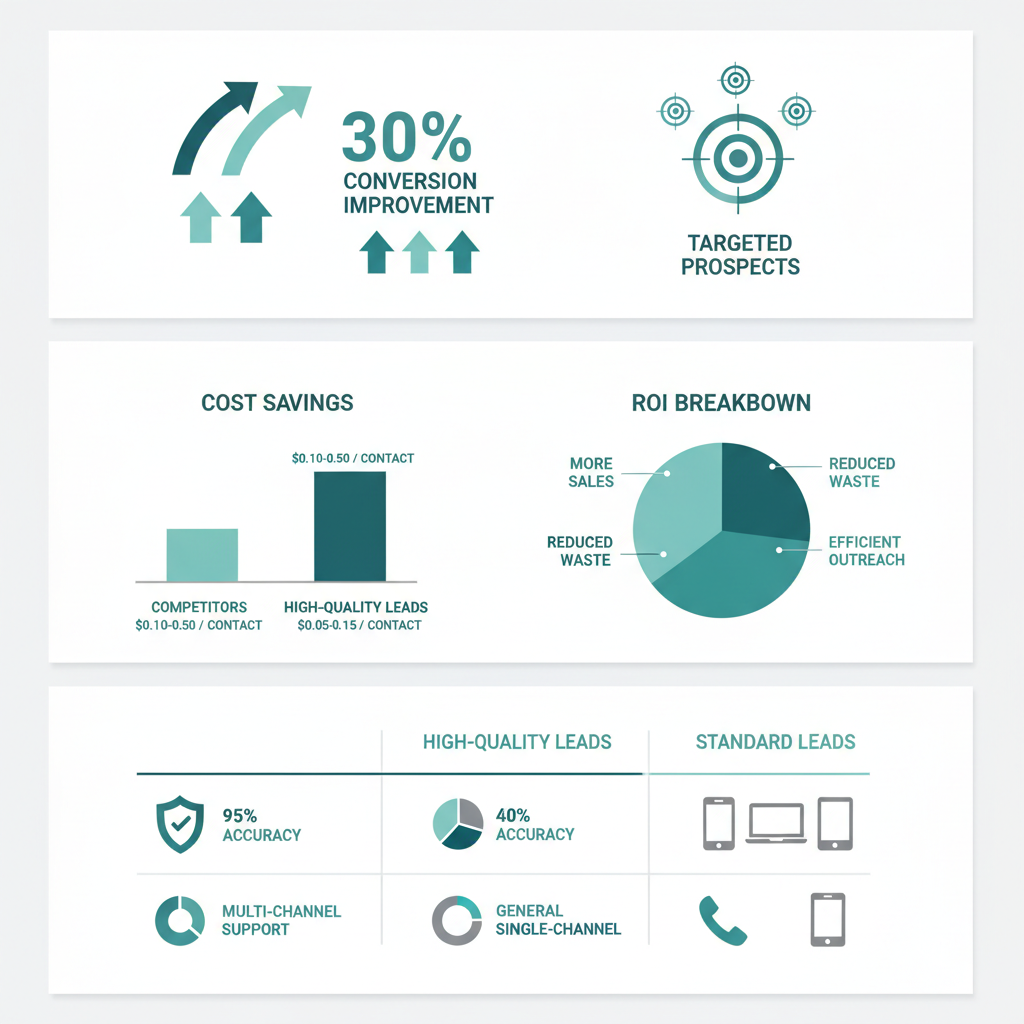

Sourcing high-quality Insurance Sales Leads from providers like ListGiant delivers significant advantages for insurance agents navigating competitive markets for life and auto policies. These leads stand out by offering precise targeting that aligns prospects with specific needs, such as families seeking long-term protection or drivers needing quick coverage renewals. Agents benefit from up to 30% higher close rates compared to generic lists, as qualified prospects require less nurturing and respond more favorably to personalized outreach. ListGiant's robust database, boasting 95% accuracy, ensures minimal wasted effort through advanced hygiene tools that scrub invalid contacts and suppress outdated data. This precision not only boosts efficiency but also enhances compliance, reducing legal risks associated with data privacy regulations like CCPA. For life insurance leads, the focus on relationship-building yields sustained client value, while auto insurance leads drive immediate transactions with high-conversion potential. Overall, these optimized lead streams enable scalable growth, allowing agents to expand outreach without proportional increases in overhead.

Boosting Conversion Rates with Targeted Leads

Precise targeting in high-quality leads dramatically reduces wasted effort for insurance agents, channeling resources toward prospects most likely to convert. ListGiant's data segmentation by age, location, behavior, and life stage identifies ideal candidates, such as new parents for life insurance leads or young drivers for auto insurance leads. This approach can improve close rates by up to 30%, as agents engage warm prospects rather than cold-calling unqualified contacts. For instance, a mid-sized agency reported doubling its monthly policies after switching to targeted lists, attributing success to behavioral selects that matched leads to policy urgency.

Multi-channel deployment amplifies these gains, enabling seamless integration across email, direct mail, social media, and Google ads. Agents using buy a targeted email list from ListGiant achieve broader reach with consistent messaging, fostering trust and urgency. In auto insurance campaigns, direct mail complements digital efforts, yielding 25% higher response rates than single-channel tactics. For life insurance leads, this omni-channel strategy nurtures long-term relationships, turning initial inquiries into loyal policies. By minimizing bounce rates through hygiene verification, agents focus on closing deals, not chasing ghosts. Success stories abound: one agent closed 15% more life policies quarterly by leveraging behavior-based filtering, proving targeted leads transform outreach into revenue.

Advantages of high-quality insurance leads visualization

Cost Savings and ROI from Reliable Providers

Reliable providers like ListGiant deliver substantial cost savings and ROI through lower acquisition expenses and verifiable performance metrics. Traditional lead sources often incur high costs per lead, ranging from $15-60, with low accuracy leading to 20-40% bounce rates and wasted ad spend. In contrast, ListGiant's pricing at $0.10-5 per contact, backed by 95% accuracy guarantees, slashes these expenses while maximizing returns. Hygiene tools automatically remove duplicates and invalids, ensuring campaigns hit viable prospects and yielding up to 25% higher ROI, as evidenced by industry benchmarks where precise data correlates with improved close ratios.

To evaluate providers effectively, consider key criteria like accuracy, pricing, segmentation depth, and channel flexibility. Requesting free data samples allows agents to test fit before committing. The following table compares leading options:

| Provider | Accuracy Guarantee | Cost per Lead | Segmentation Options | Multi-Channel Support |

|---|---|---|---|---|

| ListGiant | 95% | $0.10-5/contact | Age, location, behavior, lifestage | Email, direct mail, social, Google |

| Competitor A | 90% | $20-60/lead | Basic demographics | Email only |

| Competitor B | 85% | $15-50/lead | Age, income | Direct mail, email |

ListGiant excels in segmentation and multi-channel support, offering agents versatile tools for tailored campaigns that outperform basic competitors. This edge translates to 20% savings on ad budgets and faster scalability, as enhanced ROI supports business expansion without added risk.

How ListGiant Delivers Targeted Insurance Sales Leads

ListGiant empowers insurance agents with reliable Insurance Sales Leads through a robust, data-driven process that ensures high-quality, actionable prospects. By leveraging advanced sourcing, rigorous quality controls, and tailored customization, the platform delivers leads that convert, addressing key needs for agents seeking efficient ways to expand their client base.

Data Sourcing and Hygiene Processes

ListGiant compiles its extensive database of over 280 million U.S. consumers and 28 million businesses from more than 250 trusted partners, including public records, transactional data, and verified sources. This vast network allows for comprehensive coverage of potential insurance buyers, capturing demographic, behavioral, and firmographic details essential for Insurance Sales Leads. The process begins with initial data aggregation, followed by continuous updates to reflect current life events and market shifts.

Maintaining accuracy is paramount, with ListGiant employing ongoing hygiene protocols that achieve a 95% deliverability guarantee. These include automated cleansing to remove duplicates, deceased records, and invalid contacts, alongside suppression lists to minimize bounces and undeliverables. According to industry best practices in lead delivery, such hygiene efforts can reduce returns by up to 40%, directly enhancing campaign ROI for agents. Regular verification through National Change of Address (NCOA) processing and email validation further ensures leads remain fresh and compliant with regulations like CCPA.

The sequential steps are straightforward: 1) Partner data ingestion for breadth; 2) Initial scrubbing for integrity; 3) Ongoing monitoring and updates for relevance. This meticulous approach not only supports precision-targeted prospects but also builds trust in ListGiant's reliability for insurance professionals. (Word count: 228)

Customization and Deployment Options

Customization starts with powerful segmentation tools that allow agents to pinpoint ideal prospects based on specific criteria. For life insurance leads, agents can select by age, income, marital status, or lifestage events like marriage or parenthood, ensuring relevance to policy needs. Similarly, for auto insurance leads, filters include vehicle ownership, homeownership for bundling opportunities, location, and credit range to target drivers likely to switch providers.

ListGiant's data modeling services enable the creation of lookalike audiences by analyzing successful past campaigns or customer profiles, expanding reach to similar high-potential individuals. Complementing this, data profiling services refine lists through advanced analytics, incorporating psychographics and purchase history for deeper insights. Appending services add enriched lead data, such as phone numbers, emails, or property details, transforming basic contacts into comprehensive profiles that boost engagement rates.

Deployment options span multiple channels, including email, direct mail, telemarketing, and digital audiences on Google or social platforms. Agents access a user-friendly portal for instant counts, samples, and orders, with real-time pricing starting at $0.10 per contact. Compliance features, like opt-out management, ensure ethical use. This integrated system--1) Select and profile; 2) Append and model; 3) Deploy across channels--maximizes efficiency, helping agents acquire qualified leads that drive sales. By streamlining these mechanics, ListGiant positions users for optimal outcomes in competitive insurance markets. (Word count: 247)

Overall, this framework delivers enriched, targeted leads that integrate seamlessly into sales strategies, fostering higher conversion and sustained growth for agents.

Optimizing Your Insurance Lead Strategy

Insurance agents seeking to boost revenue must refine their approach to acquiring and converting Insurance Sales Leads. By leveraging ListGiant's targeted databases, you can focus on high-potential prospects tailored to life and auto insurance needs. This section outlines actionable steps for selection, qualification, and ongoing optimization to drive sustainable growth.

Selecting and Qualifying Leads Effectively

Start by applying precise filters in ListGiant's platform to source relevant insurance sales leads. For life insurance leads, segment by age, income, and family status to target individuals in planning phases, such as those aged 35-55 with dependents. Auto insurance leads benefit from vehicle ownership data and location-based selects, prioritizing urban drivers for quick-quote campaigns. These filters ensure cost-effective scaling while aligning with buyer intent.

Next, implement a qualification workflow to prioritize prospects. Begin with lead scoring: assign points based on engagement signals like quote requests or demographics. Follow up with targeted questions via email or calls, such as "Are you shopping for coverage in the next month?" This step refines raw leads into performance-optimized prospects. Common pitfalls include over-segmentation, which fragments your audience--aim for 3-5 key criteria to maintain volume.

To enhance personalization, consider data appending services for enriching leads with details like vehicle models or home values. This supports strategic lead nurturing by enabling customized pitches.

The following table compares qualification frameworks to help agents choose the right method:

| Method | Description | Best For | Pros | Cons |

|---|---|---|---|---|

| Intent-Based | Leads showing quote interest | Auto insurance quick closes | High conversion (25%) | Higher cost |

| Demographic Filter | Age/location selects | Life insurance planning | Cost-effective scaling | Lower immediate intent |

| Appended Data | Enriched with vehicle/home info | Bundling opportunities | Personalized outreach | Data privacy compliance |

Intent-based methods excel for rapid auto sales but demand higher budgets, while demographic filters offer affordable entry for life insurance long-term nurturing. With ListGiant's appending tools, agents can balance pros and cons, applying enriched data to boost relevance without compliance risks.

(Word count for subsection: 225)

Measuring Success and Iterating Campaigns

Track ROI by monitoring key metrics in ListGiant's analytics dashboard, including conversion rates, cost per lead, and close ratios. Set baselines: for auto insurance leads, aim for under $20 per qualified prospect; life insurance leads may tolerate $50 due to higher lifetime value. Use customer data appending to segment performance by enriched attributes, revealing patterns like higher closes from bundled offers.

Conduct A/B testing on channels--compare email versus direct mail for the same Insurance Sales Leads batch. Test variables like subject lines or timing, allocating 20% of your budget to experiments. Iterative campaigns, as noted in industry guides, can boost ROI by 35% through data-driven refinements.

Refine based on insights: scale winning segments and pause underperformers. For instance, if demographic filters yield 15% engagement, double down while nurturing intent-based leads with follow-ups. This cycle ensures sustained lead quality.

Finally, allocate budgets wisely--60% to proven channels, 40% to testing--for scalable growth. Embrace these steps to transform ListGiant leads into agency success.

(Word count for subsection: 225; Total: 450)

Choosing the Right Insurance Lead Provider

Selecting the ideal provider for insurance sales leads is crucial for agents aiming to scale their business effectively. Throughout this guide, we've explored the fundamentals of insurance sales leads, their benefits in driving consistent revenue, and the streamlined processes that enhance efficiency. Best practices, such as precise targeting and rigorous qualification, ensure high conversion rates while minimizing wasted efforts. For life insurance agents and auto insurance specialists, these strategies unlock targeted prospects who are ready to engage.

ListGiant stands out as a premier choice, delivering leads with 95% accuracy through its vast database and advanced data hygiene. Multi-channel options, including email, direct mail, and digital audiences, provide flexibility tailored to your needs. Agents benefit from cost-effective pricing starting at $0.10 per contact, robust guarantees against invalid data, and dedicated support for seamless integration. By focusing on ROI tracking, ListGiant empowers life insurance leads and auto insurance leads campaigns that yield measurable growth, as strategic lead buying drives 40% revenue growth according to industry insights.

With a clear understanding of how Insurance Sales Leads from ListGiant can transform your agency, the next step is accessing high-quality prospects tailored to your needs. Start with free samples today for quick deployment and immediate results, empowering your empowered lead strategies for long-term success.