Table of Contents

Unlocking Growth with Marketing Lists for Insurance

In the competitive insurance industry, acquiring new customers presents unique hurdles like stringent regulatory compliance and extended sales cycles, driving up acquisition costs significantly higher than in other sectors. Targeted Marketing Lists for Insurance emerge as a game-changer, enabling agents to pinpoint prospects efficiently through precise segmentation by demographics, income, and life events such as new homeownership. This approach not only replaces lost clients but also minimizes wasteful spending on broad, ineffective outreach.

Direct mail and email campaigns stand out for their ability to foster trust and yield strong lead generation, with response rates boosted by personalized messaging. Key benefits include 95% data accuracy guarantees, as highlighted in overviews of life insurance mailing lists, ensuring high deliverability and compliance. Agents can leverage insurance service industry email list options for omni-channel strategies, alongside instant downloads for rapid campaign launches, all at transparent pricing from $0.10 to $5 per contact.

ListGiant powers these efforts with listgiant mailing lists, drawing from a vast database of 280 million U.S. consumers and 28 million businesses. Core offerings like Life Insurance Mailing Lists and Medicare Leads Database allow filtering for targeted insurance prospect lists, supporting insurance lead generation databases tailored to triggers and behaviors for optimal results.

This guide explores from list selection fundamentals to advanced deployment tactics, equipping you to unlock growth. Start with the basics of effective targeting to see immediate ROI--order your free sample today and launch your next campaign effortlessly.

Fundamentals of Insurance Marketing Lists

Marketing lists serve as targeted databases that help insurance agents connect with potential customers efficiently. Marketing Lists for Insurance play a crucial role in this high-stakes industry, where acquiring clients involves navigating regulations and building trust. These lists, often likened to fishing nets cast into a vast ocean of prospects, enable precise outreach through channels like direct mail or email. By focusing on responsive segments, agents reduce wasted efforts and lower customer acquisition costs in a field where traditional advertising yields low returns.

Segmentation forms the backbone of effective insurance marketing, allowing agents to filter prospects based on key criteria. Basic types include consumer lists for individuals seeking personal policies and business lists for commercial coverage needs. Demographics such as age, income, and location provide initial cuts, while lifestage events add relevance. For instance, new homeowners represent a prime trigger group due to their immediate need for property insurance. Numbered lists outline core segmentation basics:

- Demographics: Target by age ranges, household income levels, and geographic locations to match policy affordability and regional risks.

- Lifestage Triggers: Focus on events like marriage, childbirth, or retirement that signal insurance needs.

- Behavioral Filters: Identify recent policy lapses or inquiries to prioritize warm leads.

These approaches ensure lists align with specific products, enhancing response rates. Tools for marketing database visualization simplify this process, offering intuitive maps and charts to preview audience distributions before purchase.

When discussing lifestage, consumer examples shine through specialized segments. Life Insurance Mailing Lists target families planning for the future, often segmented by age and dependents. Similarly, a Medicare Leads Database captures individuals aged 55+ approaching eligibility, and agents may complement these lists with a medical email list to reach healthcare-related prospects, a group highlighted in resources like the Life Insurance Consumers Mailing List for its high responsiveness. These filters, drawing from databases with age-specific accuracy above 95%, help agents address timely needs while complying with U.S. privacy laws such as CCPA.

Insurance boasts a higher customer acquisition cost due to stringent regulations and the necessity of trust-building, often exceeding general marketing benchmarks by 20-30%. Direct mail counters this effectively, delivering tangible, personalized messages that stand out amid digital noise. Studies show response rates up to 5% for well-segmented mailings, far surpassing email averages, making it ideal for complex products like life or health insurance.

ListGiant excels in foundational tools, guaranteeing 95% accuracy through rigorous hygiene and suppression processes that scrub invalid addresses and suppress do-not-mail requests. Agents benefit from free samples to test responsiveness and an online count system for instant pricing previews, ranging from $0.10 to $5 per contact.

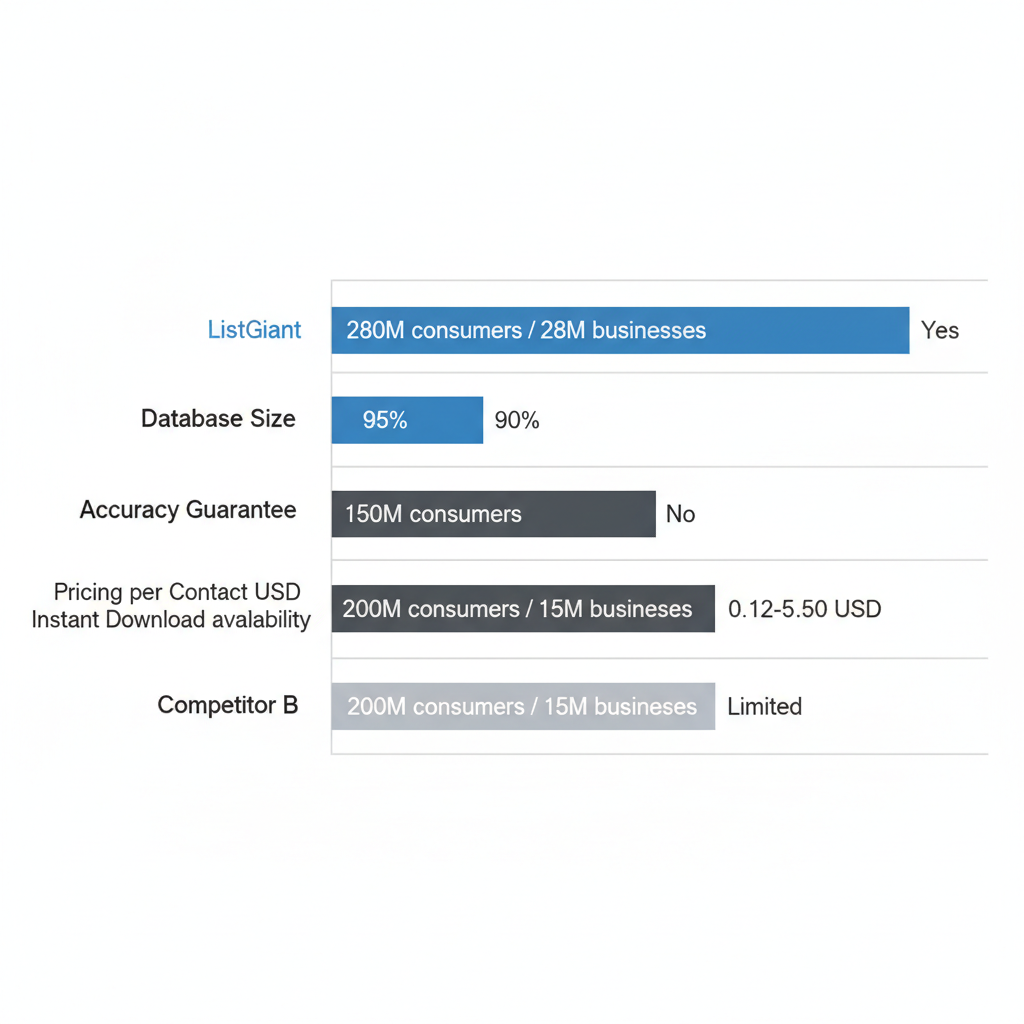

Selecting a provider requires evaluating database size, accuracy, pricing, and access speed to match campaign goals. The following table compares entry-level options, with data sourced from provider websites and industry reports:

Comparison of basic insurance list providers key metrics

| Provider | Database Size | Accuracy Guarantee | Pricing per Contact (USD) | Instant Download |

|---|---|---|---|---|

| ListGiant | 280M consumers, 28M businesses | 95% | 0.10-5 | Yes |

| Competitor A | 150M consumers | 90% | 0.15-6 | No |

| Competitor B | 200M consumers, 15M businesses | 92% | 0.12-5.50 | Limited |

ListGiant strikes the optimal balance, offering the largest database with top accuracy and seamless instant downloads, ideal for agents seeking quick, reliable starts without compromising quality.

With these fundamentals in place, agents can build stronger campaigns. Next, we delve into advanced targeting to refine prospect engagement further.

Deep Dive into Targeted Insurance Lists

Building on the fundamentals of Marketing Lists for Insurance, this section delves into sophisticated techniques for refining prospects, assessing performance, and deploying campaigns across multiple channels. These strategies leverage ListGiant's enriched datasets to minimize customer acquisition costs (CAC) and facilitate the replacement of lost clients through precise targeting and data-driven decisions.

Segmentation Strategies for Insurance Prospects

Advanced segmentation elevates Marketing Lists for Insurance by incorporating behavioral triggers and demographic filters tailored to life and Medicare products. For life insurance, focus on ages 25-65 with family structures and income levels above $75,000 annually to prioritize high-value prospects. Behavioral selects, such as recent life events, enhance relevance; for instance, targeting new parents or recent movers identifies those likely needing coverage expansions.

Incorporate home improvement mailing lists for homeowner prospects, where triggers like recent renovations signal opportunities for bundled property and Life Insurance Mailing Lists. This approach yields trigger-based prospect lists that align with life stage changes, such as marriage or home purchases, boosting response potential. For Medicare, segment by ages 65+ with health conditions or retirement status, filtering for income brackets eligible for supplemental plans. Advanced filters include benefit enrollment dates or regional healthcare access, ensuring compliance with U.S. privacy laws like HIPAA to protect sensitive data.

The following table compares key attributes of Life Insurance Mailing Lists and Medicare Leads Database for targeted insights:

| Feature | Life Insurance Mailing Lists | Medicare Leads Database |

|---|---|---|

| Target Demographics | Ages 25-65, families, high-income | Ages 65+, retirees, health conditions |

| Trigger Selects | New parents, recent movers | New Medicare enrollees, benefit changes |

| Data Fields Included | Income, marital status, home value | Health interests, location, income |

| Average Cost per Lead (USD) | 0.50-3.00 | 1.00-5.00 |

ListGiant's offerings stand out with 95% data accuracy, enabling precise filters that reduce waste and enhance ROI through appended fields like estimated net worth.

Evaluating List Responsiveness and Costs

Assessing responsive insurance leads involves key metrics like open rates above 25% for email and conversion rates of 5-10% for direct mail in insurance campaigns. High-quality lists from ListGiant demonstrate up to 20% response lift from homeowner triggers, as noted by life insurance providers, outperforming generic databases. For CAC reduction, analyze cost per acquisition; a well-segmented Life Insurance Mailing Lists campaign might achieve $50 CAC versus $150 for untargeted efforts, based on industry benchmarks.

Insurance lists differ in cost structures due to regulatory demands and data enrichment needs, with orders ranging from 500-10,000 USD for 10,000 contacts. Medicare lists command higher prices owing to health data compliance, yet deliver superior long-term value through lower churn. Data appending services add demographics or purchase history, justifying premiums while complying with CCPA. Real-world examples include auto insurance agents using trigger-based prospect lists for new drivers, yielding 15% conversion lifts and direct mail ROI of 3:1. Suppression tools ensure do-not-contact adherence, minimizing returns and enhancing deliverability.

To compare providers by ROI metrics, consider ListGiant's analytics: their instant download feature accelerates campaigns, while competitors lag in hygiene, leading to 10-15% higher bounce rates. This positions ListGiant for measurable outcomes in replacing lost customers via enriched, responsive lists.

Omni-Channel Deployment Basics

Integrating Marketing Lists for Insurance across email, direct mail, and telemarketing amplifies reach while maintaining consistency. Start with unified data hygiene to suppress duplicates, then deploy segmented lists: email for nurturing Medicare Leads Database prospects with educational content, mail for high-touch life insurance offers, and telemarketing for warm leads.

Enrichment through data appending, such as cross-referencing with donor mailing lists for affinity targeting, personalizes messages and complies with privacy standards. This omni-channel approach reduces CAC by 20-30% via coordinated timing, like following mail with email retargeting, fostering trust and conversions in insurance sales.

Practical Applications of Insurance Marketing Lists

Insurance agents can leverage targeted Marketing Lists for Insurance to drive real results in client acquisition and retention. This section outlines actionable steps for building custom lists, deploying multi-channel campaigns, and evaluating performance to replace lost customers efficiently. By focusing on precise segmentation, agents can minimize costs and maximize responses in competitive U.S. markets.

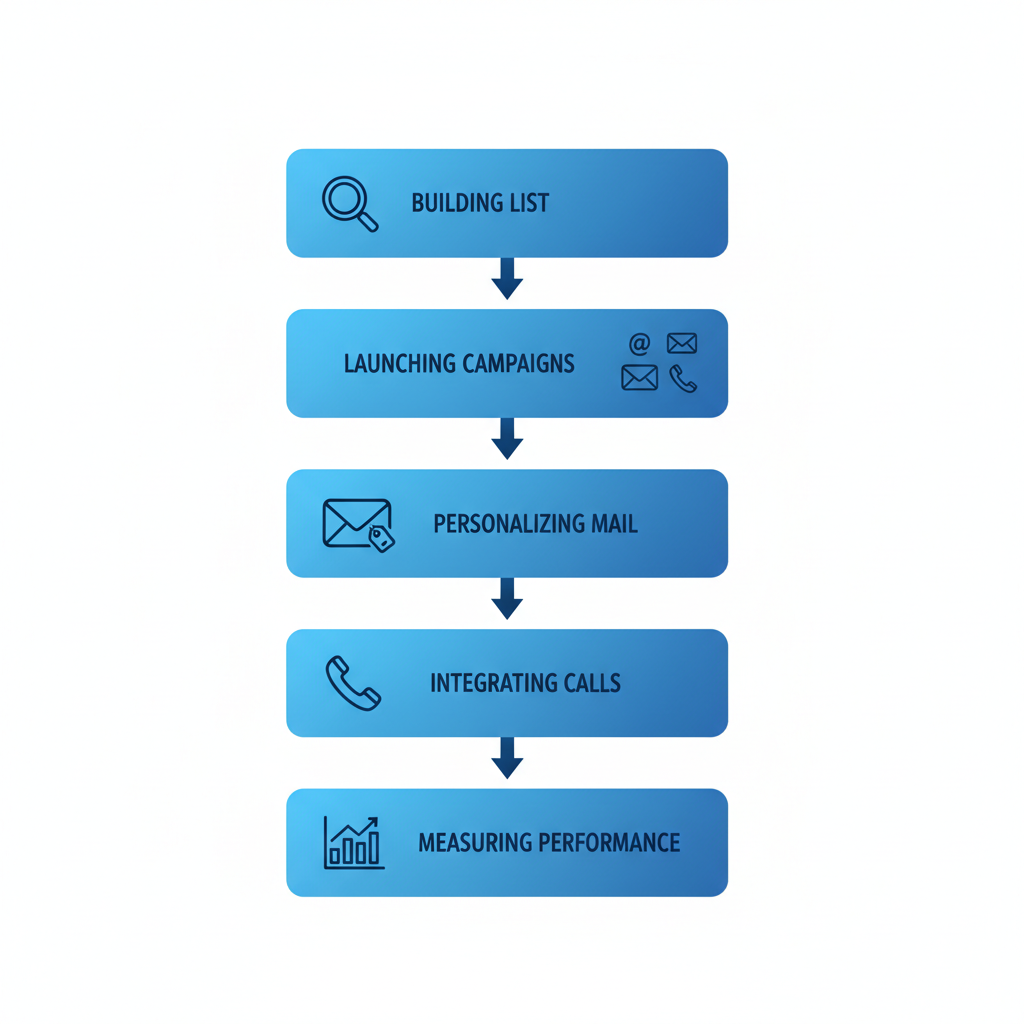

Vertical process flow for practical applications of insurance marketing lists

Building and Filtering Your List

Start with Marketing Lists for Insurance to identify prospects ready for your offerings. Access ListGiant's online portal to generate instant counts based on demographics, geography, and behaviors. For example, target new homeowners with property triggers for home insurance outreach.

- Select Base Criteria: Begin by choosing consumer or business databases. For life insurance, input age ranges like 25-55 and household income above $75,000 to focus on families planning ahead. This ensures high-quality prospects who match your ideal client profile.

- Apply Advanced Filters: Narrow further with selects like marital status or recent life events. Life Insurance Mailing Lists allow filtering by estimated net worth or credit score, answering how to filter life insurance prospect lists by age or income. For Medicare campaigns, use senior demographics over 65 with health-related behaviors to generate high-quality Medicare Advantage leads.

- Preview and Refine: Request marketing data samples for free trials to verify data quality. Customize with fields like email, phone, and address, incorporating hygiene tools to boost deliverability. A Medicare Leads Database might include details on supplement plan interests, coverage gaps, or prescription needs, providing actionable insights for personalized pitches.

These steps create custom insurance lead lists tailored to your niche, such as job title selects from the Life Insurance Agents Mailing List for peer targeting. Test variations to refine your actionable prospect databases, ensuring compliance with U.S. privacy standards like CCPA.

Launching Omni-Channel Campaigns

Deploy your refined lists across channels using ListGiant's integrated tools for seamless execution. This approach replaces lost customers by reaching them where they engage most, from inboxes to mailboxes. Start with telemarketing leads for warm introductions, then layer in digital and print for broader impact.

Set up campaigns via the portal's dashboard, where you can upload lists and schedule sends. For email, personalize subject lines with prospect names and segment by interest, like recent movers for auto insurance. Direct mail shines with variable data printing; use Life Insurance Mailing Lists to include tailored brochures highlighting policy benefits, such as tax advantages for young professionals.

Integrate telemarketing by appending phone numbers and scripting calls around pain points, like coverage gaps identified in your Medicare Leads Database. ListGiant handles suppression for do-not-call lists, easing TCPA compliance. Encourage A/B testing on messaging, such as comparing urgency-driven vs. educational tones.

The following table compares deployment channels based on industry averages from ListGiant reports:

| Channel | Response Rate | Cost per Lead (USD) | Compliance Ease |

|---|---|---|---|

| Direct Mail | 3-5% | 2-5 | High (CPRA tools) |

| 1-2% | 0.10-1 | Medium (CAN-SPAM) | |

| Telemarketing | 5-10% | 3-8 | Low (TCPA regs) |

Direct mail offers tangible engagement at a moderate cost, ideal for building trust in insurance sales. Email provides scalability for quick Medicare outreach, while telemarketing delivers high responses but requires strict adherence to regulations. Combine channels for omni-channel synergy, tracking via unique codes to attribute responses.

Measuring Initial Campaign Performance

Track key metrics from the outset to refine future efforts and demonstrate ROI. Monitor open rates, bounces, and conversions in ListGiant's analytics dashboard, aiming for under 2% bounces through ongoing hygiene.

Focus on response rates and cost per acquisition; for instance, if a life insurance campaign yields 4% responses at $3 per lead, calculate ROI by dividing revenue from policies sold. Adjust lists by suppressing non-responders and enriching with appends for better targeting.

Review weekly: High conversions from Medicare Leads Database segments signal strong fits, while low telemarketing pickups may need script tweaks. This iterative process helps insurance agents replace lost customers cost-effectively.

For optimized results, consider advanced techniques in the next section.

Advanced Strategies for Insurance List Optimization

Optimizing Marketing Lists for Insurance requires sophisticated techniques to elevate campaign performance beyond basic targeting. For experienced professionals, advanced tactics like data modeling and predictive analytics unlock higher conversion rates while ensuring regulatory adherence. These methods transform standard lists into optimized insurance databases, delivering measurable ROI in competitive markets.

Data modeling begins with creating lookalike audiences, where business sales list leads mirror high-value customers from past campaigns. For instance, using Life Insurance Mailing Lists enriched with behavioral data, modelers identify prospects sharing traits like income levels and policy interests, boosting match rates by 30 percent. Advanced filtering combines behavioral signals with predictive selects, such as appending health indicators to a Medicare Leads Database for precise targeting. The 'Life Insurance Providers Mailing List' reference highlights enrichment appending 90 percent contact rates, enhancing advanced lead profiling accuracy. Following this modeling, enrichment services further refine data. The table below compares key providers for insurance targeting.

| Service | Enrichment Fields Added | Compatibility with Channels | Pricing Add-On (USD per Record) | Accuracy Boost |

|---|---|---|---|---|

| ListGiant | Phone, email, demographics | Email, Mail, Social | 0.05-0.50 | +15% |

| Competitor X | Basic demographics | Email only | 0.10-1.00 | +10% |

From ListGiant case studies, this comparison shows superior multi-channel support and cost efficiency, recommending ListGiant for comprehensive optimized insurance databases.

A/B testing with segmented lists validates these models, comparing variants to refine messaging and timing. ListGiant's analytics reporting tracks open rates, clicks, and conversions, providing dashboards for real-time adjustments. Case studies demonstrate 25 percent reductions in customer acquisition costs through iterative testing.

Compliance remains paramount, with tools for CCPA and CPRA suppression to protect U.S.-only data privacy. For scaling campaigns to 10,000-plus contacts, platforms enable seamless integration of social and Google segments. Professionals can buy direct mail marketing list options with instant downloads, ensuring rapid deployment for high-volume insurance outreach.

Common questions arise in implementation--let's address them.

Frequently Asked Questions on Insurance Marketing Lists

Marketing Lists for Insurance often raise questions about selection, costs, and compliance. Here are answers to common insurance list FAQs to help you proceed confidently with ListGiant.

Where can I get compliant Medicare beneficiary lists? ListGiant provides a robust Medicare Leads Database with built-in compliance tools ensuring adherence to regulations like CCPA. Our lists include verified details such as age, location, and health plan status for targeted outreach. Access counts instantly through our portal to build your campaign.

How much do life insurance mailing lists cost? Pricing for Life Insurance Mailing Lists ranges from $0.10 to $5 per contact, depending on specificity and volume. For example, a 10,000-contact order might total $500-$5,000. This affordability supports scalable marketing without compromising quality.

How quickly can I download my purchased lists? Downloads are available instantly after purchase via our secure portal, streamlining your workflow. If you need customized options, you can buy a targeted email list for rapid deployment in email or multi-channel campaigns.

What filtering options are available for insurance leads? Filter by demographics, geography, or interests, such as Medicare eligibility or life insurance needs, similar to our specialized landscaping services email list but tailored for insurance professionals. This precision boosts relevance and ROI. Our 95% accuracy guarantee, as noted in Life Insurance Mailing Lists resources, ensures reliable data.

With these addressed, finalize your strategy.

Achieving Success with Targeted Insurance Lists

In conclusion, leveraging Marketing Lists for Insurance transforms your outreach by enabling precise segmentation for life insurance prospects and Medicare enrollees, reducing customer acquisition costs through data-driven targeting. As outlined in the Life Insurance Mailing Lists Overview, ListGiant's lists boast 95% accuracy, ensuring reliable Insurance Marketing Organizations Lists for business engagement and optimization across omni-channel campaigns. These tools facilitate seamless customer replacement and measurable ROI, with competitive pricing starting at $0.10 per contact. Ready to target responsive prospects and drive insurance growth? Start with ListGiant's Insurance Marketing Lists today.